Return to Growth in 2025

This quarter the CPA revised their construction output to decrease by 2.1% in 2024, this is compared to their forecast in the second quarter of a decrease of 2.9% in 2024, so a slightly more optimistic view. The forecast of 2% growth in 2025 remains the same in the latest CPA Construction Industry Forecasts 2024-2025, Winter 2023/24. The forecast does not take into consideration the outcome of the recent UK Budget.

On 30th November the Chancellor presented a demanding Budget that the CPA perceives as offering a basis for cautious optimism. While emphasising the need to stabilise the UK's finances and foster economic growth, several initiatives aimed at bolstering the construction and manufacturing sectors, as well as addressing the CPA’s primary concerns, were introduced. These include immediate increases in funding for affordable housing projects and improved household energy efficiency through the Warm Homes Plan over the next three years. Ongoing capital investment in the repair and maintenance of hospitals and schools was also confirmed. This cautious optimism offers hope of a return to better growth in 2025.

‘Historic Sales Volumes' indicate that in the last quarter CAB Members report flat-lined, ie. similar to the previous quarter however, 55% of the wider Construction Industry on net balance suggest that sales volumes have increased over the quarter. The trend over the year shows a steady growth for the wider Construction Industry. This will feed into the aluminium facade supply chain in the coming quarter reports.

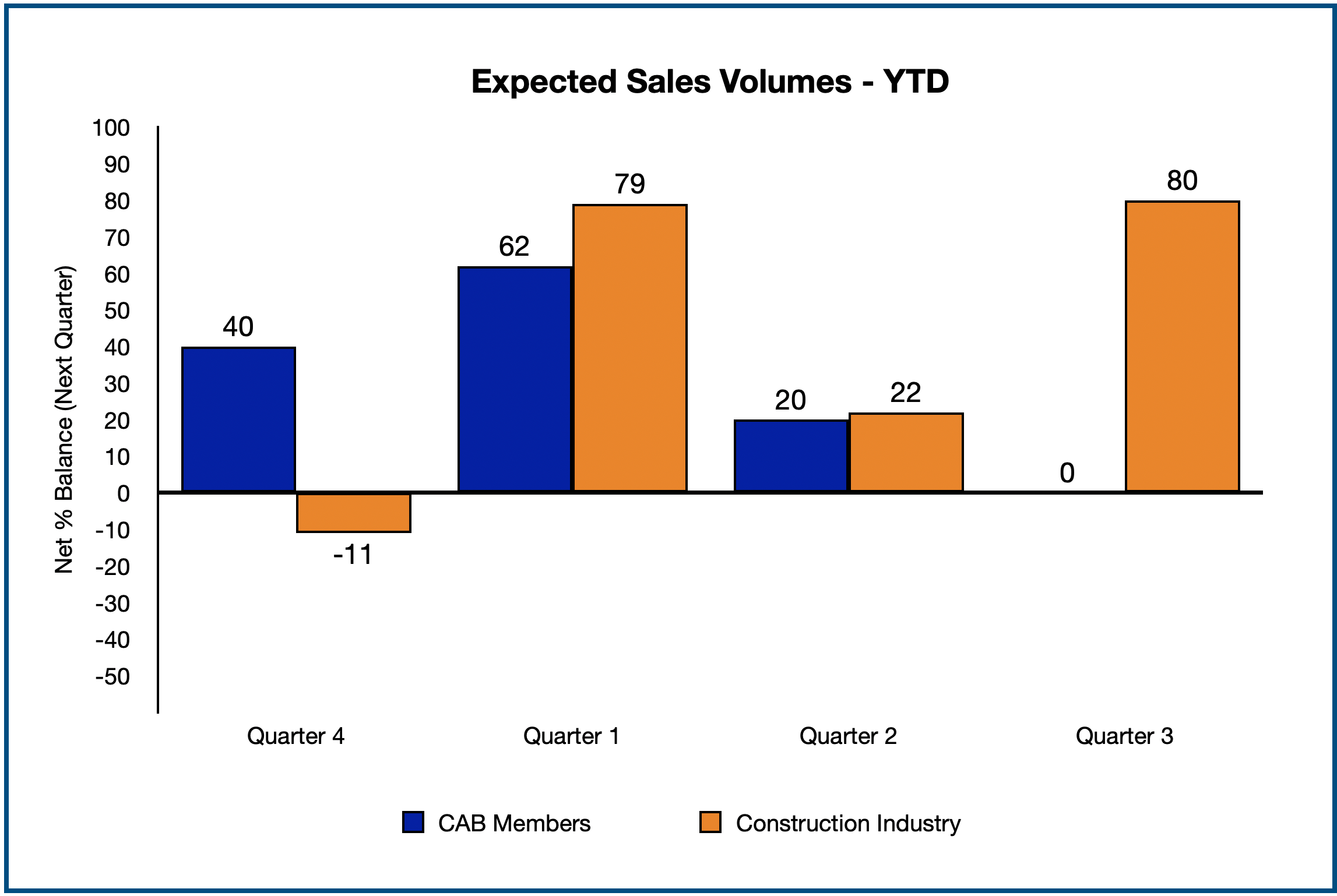

‘Expected Sales Volumes’ for CAB Members also flat-lined for the next quarter and the year ahead, these results for Q3 could create uncertainty regarding the pending budget at the time the report was commissioned. The wider Construction Industry shows a lot of optimism with 80% of companies, on net balance, expecting an increase in sales volumes for the next quarter and the year ahead. On trend, CAB members have seen a reduction in confidence in the market since Q1 when the expected sales volumes for Q2 stood at 62% on net balance of reporting members.

‘Sales Volumes - Year-on-Year’ indicate that 90% of CAB members have experienced lower sales, with 40% reporting a drop of over 5% sales volumes year-on-year. Just 10% of Members reported a growth in the last year.

‘Historic Unit Costs’ indicate that the pressure of increased costs is reducing for CAB Members. Since Q1 respondents have reported a reduction of 50% to 20% on net balance. The wider Construction Industry report a slight reduction over the last quarter, but still remains high at 50% on net balance reporting increased unit costs.

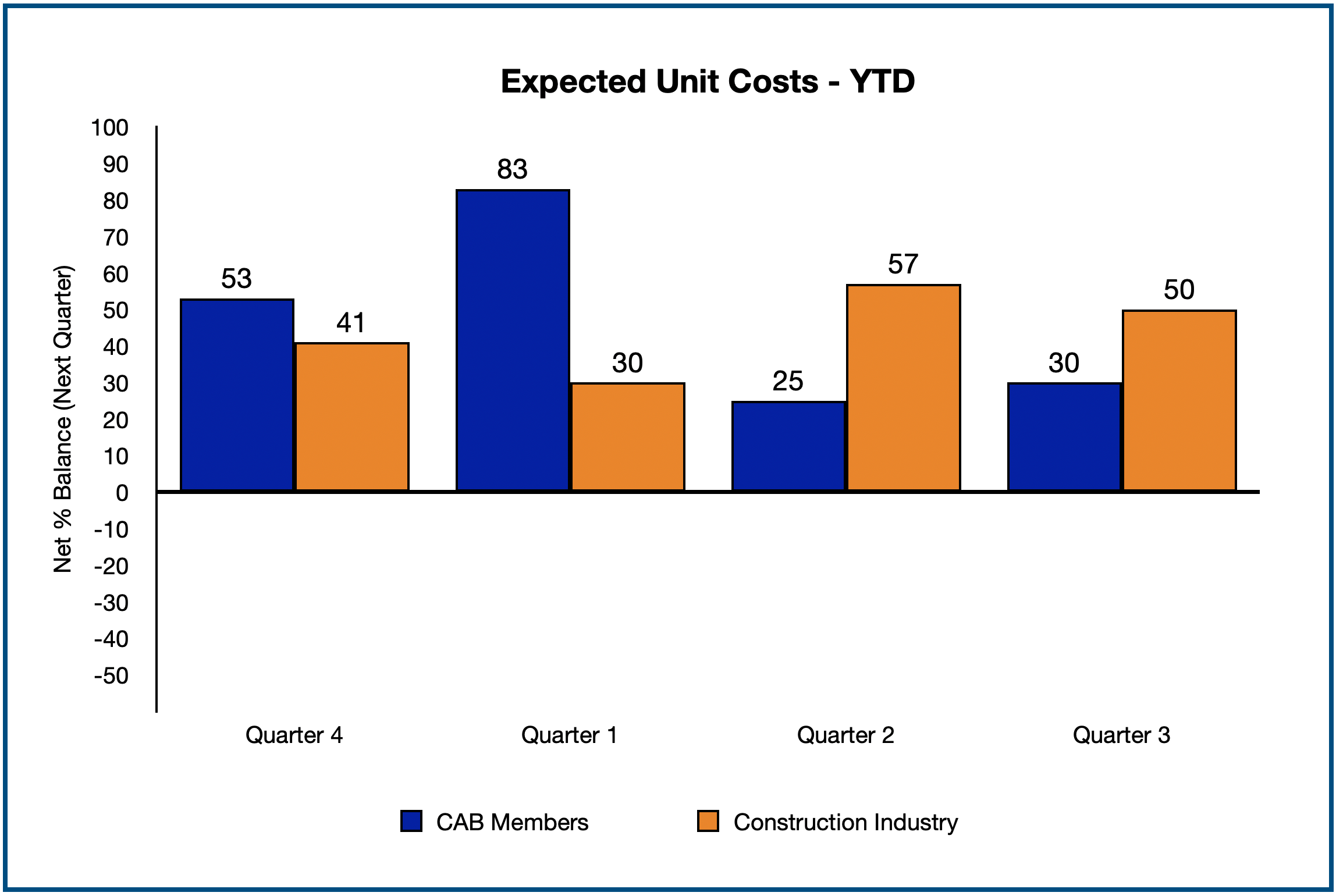

Looking forward, ‘Expected Unit Costs’ are expected to rise in the next quarter across the Construction Industry with 30% of CAB Members on net balance reporting likely increases and 50% of the wider Construction Industry on net balance expecting increases. The trend in general is an easing of reported increases since Q1 2024

With ‘Cost Factors’ CAB Members see raw material cost as the greatest influence, closely followed by wages & salaries. Fuel costs and exchange rates have reduced, which offsets some of the increases during the quarter.

‘Likely Constraints on Activity Over the Next 12 Months’ is firmly reported at 80% by CAB Members as market ‘Demand. This indicates an opportunity for growth of sales without constraints in the coming months. This is reflected by ‘Historic Capacity Utilisation’ and ‘Expected Capacity Utilisation’ for the coming quarter where only 10% of companies report operating at over 90% capacity.

Whilst ‘Labour Force’ for CAB Members indicates a reduction in the year a head on net balance of respondents, the wider Construction Industry does not see any change in the year ahead. As the pressure in labour force reduces for CAB members, labour cost pressures also reduces to 20% of members reporting increases on net balance of respondents. This is in stark contrast to the wider Construction Industry that reports increases in the last year and the year ahead at 100% on net balance.

On ‘Capital Investment’, CAB Members continue to prioritise investment in ‘Product Improvement’ with 60% on net balance of respondents reporting developments in products and services.

More information about CAB’s 2025 events is available through the CAB website. It is important to recognise that an Association belongs to its Members and the more influence that Members can bring into the Association, the further it will grow. The CAB Board of Directors are committed to grow the Association and continue to increase value for membership. Should you wish to learn more about the use of Aluminium used in Construction, please contact CAB, join the Association and be recognised as being involved in supporting your Industry and helping to shape its future. More information on our website at c-a-b.org.uk